Exports Decline Across the Board

Merchandise exports in Thailand based on balance on payments contracted by 5.6% year-on-year in October compared to a more moderate -4.2% form the month before.

This accelerated decline in exports ended the the three-month rebound under way since July.

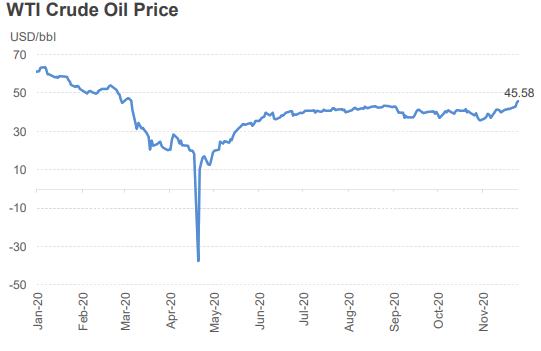

A local drought and weaker global demand for fuels drove exports in agro manufacturing products (-4.4% yeart-on-year) and petroleum-related products (-16.6% year-on-year) lower.

Also on of the main growth drivers of the last few months, exports in electronics, trended lower to 3.5% year-on-year in October after still growing at a solid 9.9% year-on-year in September.

Mirroring the decline in exports, imports contracted by 12.1% year-on-year, accelerating September’s -8.1%

As a result, the kingdom’s current account surplus stood a mere USD 1.0 surplus for October.

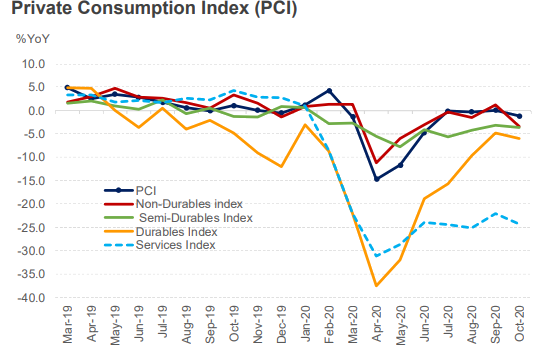

Private Consumption Slipping

Private Consumption decreased in October with the Private Consumtion Index (PCI) losing 1.1% year-on-year. In contrast, the PCI still edged up 0.4% year-on-year in September.

In the same period last year, the Chim-Shop-Chai campaign caused a high consumption base. In comparison, household spending softened in almost every category this year.

Consumption also deteriorated by 1.1% month-on-month basis from September, mainly because of lower spending after special holidays in September had passed.

External Demand for Rubber Gloves Remains Strong

Due to continued strong external demand for rubber gloves causing elevated rubber prices, farm income surged by 12.2% year-on-year in October from 9.7% in September.

At the same time, inflation, as expressed in the Consumer Price Index (CPI) edged down by -0.5% year-on-year compared to -0.7% in September. The main reasons were higher prices in oil and in food.

Recovery in Manufacturing Slowed

Along with slowing consumption and exports, Thailand’s manufacturing production recovery eased to an October MPI of 0.5% year-on-year. Still, this is an improvement from September’s MPI of -2.1% year-on-year.

In contrast, the capacity utilization declined to 63.9% from 64.0% in September.

In line with lower capacity utilization, Thailand’s Private Investment Index (PII) receded by 4.9% year-on-year in October from only -2.0% year-on-year the month before. Also, the PII worsened in all investment categories except construction materials.

Thailand Economic Recovery Likely Incremental From Here on

Thailand’s abrubt economic recovery of the last few months will likely remain just that, the past.

From now on, a Thailand economic recovery will rather advance in incremental steps.

A first reason is that activities have returned to almost normal with heightened post lockdown demand already faded.

A second reason for a dwindling economic recovery in Thailand lies in the fact that most economies still experience declining tourism income and fragile consumer confidence as conrona virus infections are on the rise for a second wave.

So the Thailand economic recovery also dwindles as global business activities worldwide remain low due to renewd lockdown measures.

And while there have been promising news about vaccines putting an end to the pandemic, it yet has to be seen how further development and distribution will play out in reality.