Thailand Economic Indicators: Exports and Imports Declined in September

In August, total exports contracted by 4.0%, Year-on-Year, and they continued to fall in September by 1.5% Year-on-Year (YoY). The main drivers for this further retreat were oil-related products (-16.2% YoY), machinery and equipment (-9.5% YoY), and electronics (-3.3% YoY).

Imports were also down in September by 4.5% YoY. Leading the decline in imports were fuels (-21.3% YoY) and raw materials and intermediate goods (-9.7% YoY).

Given the sharper decline in imports than in exports, the trade balance resulted in a surplus of US$ 2.7 for September. For the third quarter of the current year, these latest import and export figures result in zero export growth and a 6.8% YoY contraction in imports. The trade surplus now stands at US$ 8.0 bn.

Tourist Arrivals in Thailand Have Expanded for Four Consecutive Months

In September, total visitor arrivals in the kingdom advanced by 10.1% YoY to 2.9 million after already substantial growth of 7.4% YoY growth the month before. Chinese visitors lead the increase with a healthy +31.6% YoY rebound.

Chinese tourist arrivals to Thailand surged for two reasons: Firstly, the substantial rise is the effect of a comparatively low base of the same period last year. And secondly, Thailand profited from tourists avoiding Hong Kong due to the ongoing protests in the autonomous territory.

Income from tourism receipts grew by 8.7% YoY to US$ 4.6 bn. For the third quarter in 2019, the increase in total tourist arrivals rose now stands at 7.2% YoY with tourism revenue up by 5.8% YoY

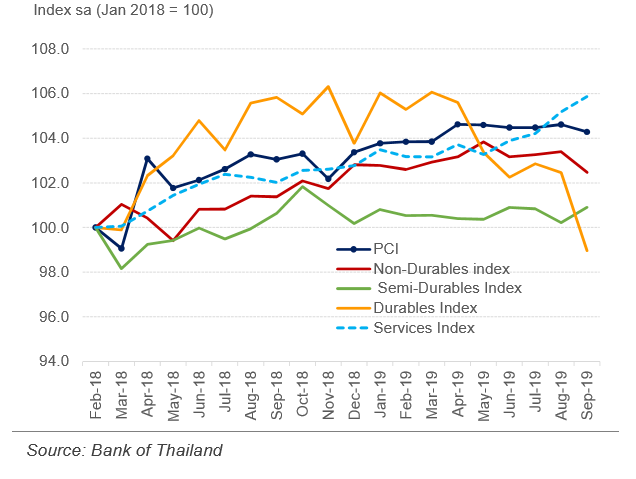

Private Consumption Gained slightly, but Further Weakness Expected

The Private Consumption Index (PCI) expanded somewhat from 1.0% YoY in August to 1.3% YoY in September mainly because of improvements in purchases of services (+3.7% YoY) and semi-durable goods (+1.3% YoY, see chart below).

However, a more significant weakening in durable goods purchase from -4.0% YoY last month to -5.7% YoY in September hint at the further slowing of private consumption. Nose-diving passenger car-sales of -30.5% YoY notably feed a soft outlook.

Farm income gained by 4.0% YoY fueled by higher agricultural prices, in particular of sticky rice and Jasmine rice. For the third quarter, the PCI advanced by 1.4% YoY. Farm income gained 2.4% YoY.

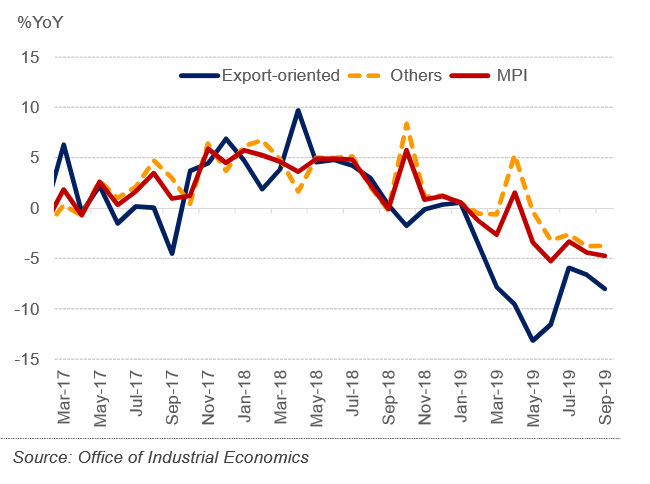

Thailand Manufacturing Production and Investment Contraction Intensified

The Manufacturing Production Index (MPI) of the Thai economy softened by 4.7% YoY in September following a 4.4% YoY fall in August (see chart below).

The export-oriented sectors electronics (-21.3% YoY), computers (-9.4% YoY), and automotive (-5.0% YoY) were the main culprits of the deterioration in manufacturing production. The third quarter MPI contracted by 4.2% as a result.

At the same time, the Private Investment Index (PII) receded 3.9% YoY, following a 6.3% YoY drop the month before primarily due to dampened investment in machinery (-8.0% YoY) and construction (-4.1% YoY). Third Quarter PII declines now stand at 3.4%.

Thailand Economic Indicators Document a Deceleration in Economic Activities

Particularly consumption, investment, and manufacturing production softened further in September.

The slow-down of the Thai economy was, however, bolstered by gains in tourism during the third quarter of 2019.

The current account surplus now stands at US$26.4 bn for the first nine months 2019, which is the primary foundation for the continued strength of the Thai baht.