On the 6th of November, the Monetary Policy Committee (MPC) voted with a 5:2 decision to cut the policy rate from 1.50% to 1.25%. While a survey polled by Bloomberg favored holding the rate steady, the case for further rate cuts proved too strong as the outlook for growth of the Thai economy and inflation had further deteriorated recently. It was likely the last policy move by the MPC for the current year. However, expect additional easing next year unless there are positive surprises in the business activity.

The BOT Finally Followed Global Central Banks’ Dovishness

The Bank of Thailand eventually gave in to the prevailing global monetary policy and delivered one more cute rate. The Federal Reserve’s third rate cut on the 31st of October is likely to have convinced the BOT to lower its policy rate as well. The BOT is still tracking other central bank’s policy rates and is therefore expected to ease its monetary policy again in early 2020.

The 1.25% was the lowest policy rate set by the BOT during the global financial crisis in 2008, and market observers see it as a signal of how low the Bank of Thailand is willing to adjust the policy rate downwards.

BOT Lowers Policy Rate in Response to Latest Economic Indicators

But it wasn’t only other central banks rate cuts that promoted the BOT to the next move, further slowing of the Thai economy must have played a role too.

Weakening exports, private consumption, and manufacturing indicated that the Thai economy slowed even more than previously anticipated. There is a chance that GDP forecasts for the current year will have to be lowered once GDP figures are published on November 18th.

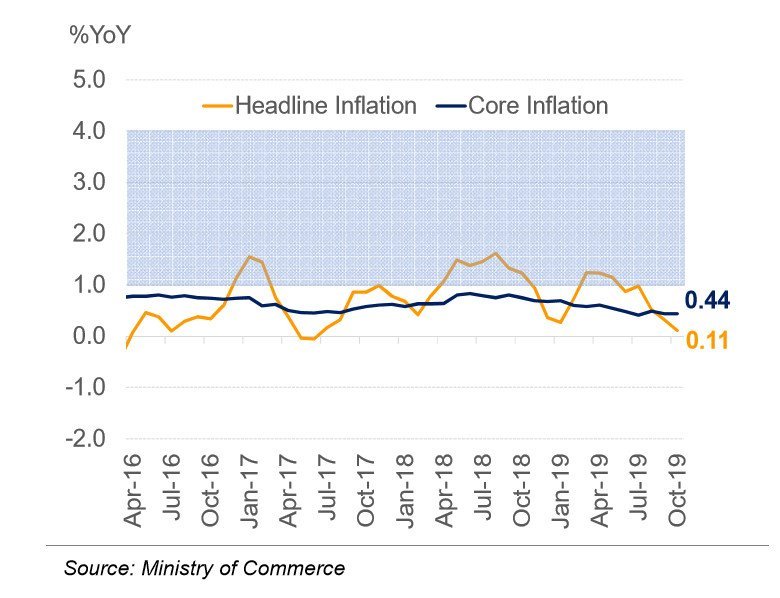

The BOT Expects Headline Inflation to Miss Target in 2019-2020

The MPC believes that weaker energy prices and structural market changes, like the increasing competition in retail markets caused by e-commerce players, are behind the current restraint inflation rates.

It is unclear when inflation will return to BOT targets. (see chart below).

Strength of THB Likely to Prompt Another Rate Cut

The Thai Baht has appreciated by about 6% against the USD regardless of two BOT rate cuts and various measures to counterbalance further appreciation of the currency. While the THB continues to act as a safe-haven currency in emerging markets, it also increases the likelihood of another rate cut by the BOT.

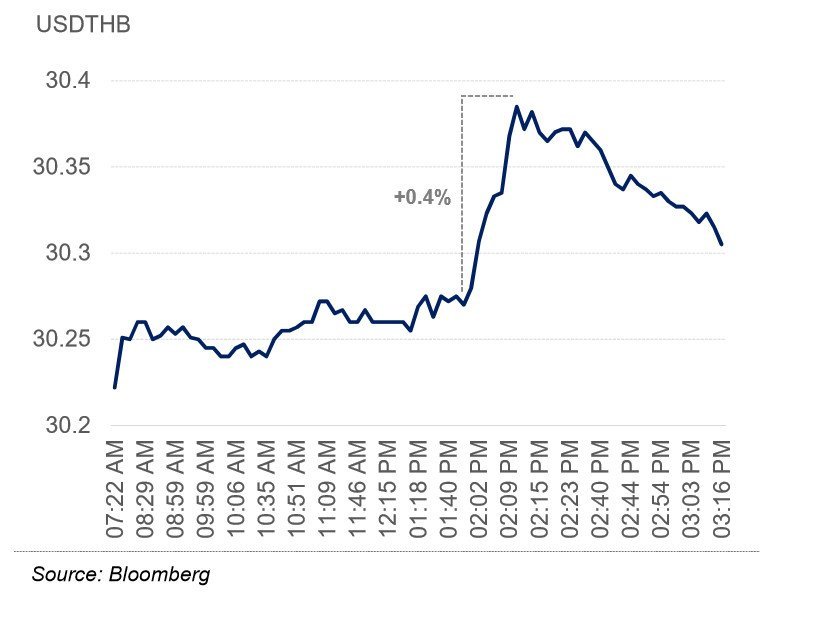

BOT Announced Further Relaxation of Foreign Exchange Policy

Along with its policy rate cut, the BOT announced four measures aimed at tackling the continuing strong Baht. The most meaningful of the standards allows retail investors to invest up to USD 200,000 per year in foreign securities directly. Previously they would have to make investments via an intermediary. After the announcement, the THB softened by about 0.4 % (see chart below) but recovered losses soon after. This movement indicates that the market appears to understand the effectiveness of the latest FX measures as limited.

How Are Thai Commercial Banks Reacting to the Policy Rate Cut?

BOT Lowers Policy Rate, how are Thai commercial banks going to react? After the previous rate cut in August, commercial banks reduced MRRs and MORs while leaving the MLRs at the same rate. In case commercial banks lower their MLRs too, profits may take a short term hit. For many firms and households, however, this could be the desired move to lower interest loads.